Last day that the Supreme Court will be in session today and the eagerly awaited decision on T’s taxes will be announced this morning…shortly. Let’s hope it is a

Around 10 a.m. Thursday, the justices are set to issue highly anticipated decisions on whether the president’s accountants and bankers must disclose information about his financial affairs.

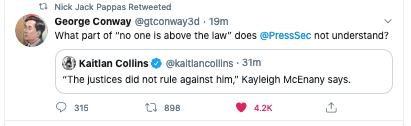

WASHINGTON — Around 10 a.m. Thursday, the Supreme Court is set to decide whether President Trump can block the release of his financial records. The ruling, concerning tax returns and other information the president has fought hard to protect, is likely to yield a major statement on the power of presidents to resist demands for information from Congress and prosecutors.

Here is a look at the two cases, one concerning subpoenas from House committees, the other a subpoena from the Manhattan district attorney, Cyrus R. Vance Jr., a Democrat.

What are the issues in the cases?

Broadly speaking, they concern whether Mr. Trump can block subpoenas to his accountants and bankers from House committees and New York prosecutors.

What happens if Mr. Trump loses?

The accounting firm and the banks have indicated that they will comply with the subpoenas. Had the subpoenas sought evidence from the president himself, there was at least a possibility that he would try to defy a ruling against him, prompting a constitutional crisis.

What information do the House committees seek?

The House Oversight and Reform Committee is investigating hush-money payments to a pornographic film actress and whether Mr. Trump inflated and deflated descriptions of his assets on financial statements to obtain loans and to reduce his taxes. The House Financial Services and Intelligence Committees have sought an array of financial records related to the president, his companies and his family.

What have Mr. Trump’s lawyers said?

They contend that the committees have no legitimate need for the information.

What is the House’s response?

Lawyers for the House say the information is needed to allow it to conduct oversight and to draft legislation.

What information does Mr. Vance seek?

He wants eight years of business and personal tax records in connection with an investigation of the role that Mr. Trump and the Trump Organization played in hush-money payments made in the run-up to the 2016 election. Mr. Trump and his company reimbursed Michael D. Cohen, the president’s former lawyer and fixer, for payments made to the actress, Stormy Daniels, who said that she had an affair with Mr. Trump.

What have Mr. Trump’s lawyers said?

They contend that he is absolutely immune from criminal investigations while he is in office. They add that allowing state and local officials to subpoena sitting presidents could subject them to politically motivated harassment.

What is Mr. Vance’s response?

Mr. Vance said the Supreme Court’s decision in 1974 in United States v. Nixon, which required President Richard M. Nixon to disclose tapes of Oval Office conversations, essentially decided the central issue in the case. “This court has long recognized,” Mr. Vance wrote, “that a sitting president may be subject to a subpoena in a criminal proceeding.”

What is the Justice Department’s position?

The Justice Department, arguing in support of Mr. Trump, who is represented by private lawyers, said none of the subpoenas satisfied the demanding standards that it said apply when information is sought about a sitting president’s private conduct.

, the one with hush money payments to the pornstar, Stormy Daniels?

, the one with hush money payments to the pornstar, Stormy Daniels?