Welcome to Mitch’s graveyard, we all just live here now.

Fed’s Powell: Recovery Depends On Stopping Virus, Government Relief

The resurgence in coronavirus cases in recent weeks is weighing on US economic activity, and a recovery will depend on both checking the virus and governmental aid, Federal Reserve Chair Jerome Powell said Wednesday.

Halting the spread of COVID-19 is key as American consumers will not start spending again until they feel it is safe to do so, Powell said, but in the meantime some additional support will be needed to make it through the worst crisis in recent memory.

With the United States’ case count on the rise and recent indicators showing the tentative rebound from the downturn may be stalling, the policy-setting Federal Open Market Committee (FOMC) held the benchmark lending rate at zero as expected.

The committee stressed the “tremendous human and economic hardship” caused by the pandemic, and the uncertainty about the coming months.

Powell told reporters the outlook "will depend in large part on our success in keeping the virus in check."

"The path forward will also depend on policy actions taken at all levels of government to provide relief and to support the recovery for as long as needed," he said.

The comments came as Republicans and Democrats in Congress are locked in debate over their dramatically different views on the next emergency spending package.

As expanded unemployment payments and a moratorium on evictions are set to expire, Senate Republicans this week unveiled a $1 trillion proposal that slashes additional weekly jobless benefits to $200 a week from $600, but also would offer a second round of $1,200 payments to individuals and give funding to schools, provided they reopen.

But Democrats are pushing for a $3 trillion plan that retains the higher unemployment payments.

Powell has been careful to avoid treading into the dangerous area of advising legislators, but he again made clear that more spending would be appropriate.

"The current economic downturn is the most severe in our lifetimes… and it will take continued support from both monetary and fiscal policy" to achieve a recovery, he said.

Economists expect GDP in the second quarter to have contracted more than 35 percent, but the Fed chief said the initial rounds of support from Congress "made a critical difference to families, businesses and communities across the country."

But he warned, "we have seen some signs in recent weeks that the increase in virus cases and the renewed measures to control it are starting to weigh on economic activity."

Authorities in states like California, Texas and Arizona have had to reimpose restrictions and close businesses, and data show the rebound in employment has slowed.

Powell said the economy in May and June recovered about a third of the more than 20 million jobs lost in the early weeks of the pandemic shutdown, but those gains are now at risk.

The FOMC repeated its intention to hold rates near zero "until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals."

But it refrained from making a more explicit commitment to allowing inflation to rise beyond the Fed’s longstanding 2.0 percent target before tapping the brakes on the stimulus it is providing to the economy.

Many economists are expecting a change in this “forward guidance” but few thought it might happen before September given the growing uncertainty around the economic outlook.

Powell said central bankers discussed “possible enhancements to our statement on longer-run goals and monetary policy strategy,” but declined to go into detail until the review is complete.

"In short, this is a holding operation, pending developments with both the virus itself and fiscal policy," said Ian Shepherdson of Pantheon Macroeconomics.

The Fed also extended a facility to provide US dollars to nine foreign central banks through March 2021 to “ease strains in global dollar funding markets” caused by COVID-19.

Almost 30 Million in U.S. Didn’t Have Enough to Eat Last Week

Food insecurity for U.S. households last week reached its highest reported level since the Census Bureau started tracking the data in May, with almost 30 million Americans reporting that they’d not had enough to eat at some point in the seven days through July 21.

In the bureau’s weekly Household Pulse Survey, roughly 23.9 million of 249 million respondents indicated they had “sometimes not enough to eat” for the week ended July 21, while about 5.42 million indicated they had “often not enough to eat.” The survey, which began with the week ended May 5, was published Wednesday.

The number of respondents who sometimes had insufficient food was at its highest point in the survey’s 12 weeks. The number who often experienced food insufficiency was at its highest since the week ended May 26.

Food insecurity will continue to rise as the pandemic, the largest humanitarian crisis in living memory, further impacts the US economy.

U.S. Economy Contracted at Record Rate Last Quarter; Jobless Claims Rise to 1.43 Million

The U.S. economy contracted at a record rate last quarter and weekly jobless claims rose for the second straight week, amid signs of a slowing recovery as the country continues to struggle with the coronavirus pandemic.

The Commerce Department said U.S. gross domestic product—the value of all goods and services produced across the economy—fell at a 32.9% annual rate in the second quarter, or a 9.5% drop compared with the same quarter a year ago. Both figures were the steepest in records dating to 1947.

Did a third of the economy really vanish in just three months?

That 32.9 percent represents the loss of a third of the economy. Let that sink in. Now let it wriggle back out again — it is not exactly true. Why? The Commerce Department reports quarterly GDP at an annual rate to allow easy comparisons to other time periods. Remove the annualization, and we see the economy contracted a still-abysmal 9.5 percent.

In other words, 32.9 percent is how much the economy would shrink if the business closures and spending cuts of the second quarter increased at a compounding 9.5 percent for an entire year, after adjusting for seasonality.

Think of what an apocalypse that would be. Annualization assumes the businesses closed this quarter would remain closed and that just as many more would close for the first time in the third quarter. And we’d expand the closures again in the fourth quarter and again in the first quarter of next year.

In other words, take the devastation you saw in the past three months and multiply it by four. That is essentially what annualizing does, though compounding means the actual mathis a bit more complicated.

The economic recovery depends on a healthy nation, and getting the Coronavirus under control, which at this juncture seems like a far off notion unfortunately given the lack of leadership, and lack of adherence to wearing masks, keeping distanced etc. The one specific deadline which Congress should be especially wary of would be the umemployment relief - with R’s offering to do a week’s patch for unemployment benefits and Dems saying no, we won’t work piecemeal.

The bigger picture, beyond the nation stricken with the rising numbers of Covid-10 is of course is huge unemployment now with the Senate now negotiating at the 11th hour over umemployment benefits, the $600 addition to them, liability issues for companies and institutions, how much to spend towards testing, tracing etc and a way back.

Congress is now in recess officially with a few leaders negotiating now for a final bill.

Read where they are…some happy talk, with some read blockades towards resolving it.

Washington (CNN)The US economy, plagued by a resurgent pandemic, is showing signs of sliding backwards.

Key deadlines on extending a federal eviction moratorium and federal unemployment benefits have come and gone. Yet lawmakers and the White House, sources say, are as far apart as they’ve ever been in talks on the next emergency aid package.

As one person involved told CNN on Sunday night: “No clue how we get this done at this point. Just so much outstanding.”

Bottom line

Negotiators on both sides emerged from a three-hour-plus meeting on Saturday with by far the most positive words about where things stood. What that really underscored was just how much of a mess these talks have been. The meeting was productive because negotiators left with a better understanding of the full scope of disagreements (and areas of potential agreement), according to two sources. Not because they’d made headway toward an actual deal.

What to read

Very good recap of a day that underscored Saturday’s optimism was short-sighted.

What to watch

Treasury Secretary Steven Mnuchin and White House chief of staff Mark Meadows will be back on Capitol Hill to meet with Speaker Nancy Pelosi and Senate Democratic Leader Chuck Schumer.

The framing

Pelosi and Mnuchin dig in on stimulus positions ahead of scheduled Monday talks

To understand why the two sides remain so far apart, it’s worth comparing how each is framing the scale of the crisis. Mnuchin, during the talks over the initial $2.2 trillion CARES Act, dismissed concerns about deficits due to historically low borrowing costs and the urgency of the moment. That has shifted – on Sunday he made a point of noting concerns about adding to much to the national debt in the next round.

This, on the other hand, was how Pelosi framed things in a letter to her House Democratic colleagues on Saturday night:

“All parties must understand the gravity of the situation in order to reach an agreement that protects Americans’ lives, livelihoods and the life of our democracy.”

There are a large number of policy differences here, but the biggest issue throughout the first week-plus of real negotiations has been the lens through which the two sides view the scale of the current crisis. And until that starts to merge, at least somewhat, there is no deal to be had.

The timing

The policy deadlines, at least up to this point, didn’t spark a deal. The Senate is scheduled to leave for August recess at the end of this week, but there’s zero sense something will come together before then. Neither side wants to leave town for the month without reaching an agreement, but at this point, that agreement – and then the process of actually getting it through both chambers – is a long way off.

"I’m not optimistic that there will be a solution in the very near term," Meadows said on CBS’s “Face the Nation.”

…

Addressing the “unilateral” idea

There has been chatter for several weeks that the White House may look to pursue unilateral options to address the economy if it feels a deal with Democrats is out of reach. On Capitol Hill, those who were aware of the talk mostly just laughed it off. But it spilled into public view Monday with The Washington Post reporting it was becoming a very real option given how far apart the two sides remain.

Let’s go ahead and address this head on: there is nothing the White House can do on unemployment benefits unilaterally. There is nothing they can do in terms of sending out another round of stimulus checks. There is nothing they can do on liability protections. There are limits to what they can do regarding an eviction moratorium. There is nothing they can do in terms of allowing hard-hit small businesses to access a second Paycheck Protection Program loan.

…

The biggest holdups

(Again, these are the biggest picture items. There are dozens of smaller-bore issues that will also create disagreement or problems that the negotiators haven’t really gotten to yet, sources say.)Federal unemployment benefits State and local funding Liability protections Postal Service fundsThe areas of agreement

Paycheck Protection Program Direct Payments

The Trump administration is reportedly considering unilateral action on enhanced unemployment benefits and an eviction moratorium if no deal is struck with Congress

- The Trump administration is considering taking unilateral action on measures like enhanced unemployment insurance and a moratorium on evictions if it can’t agree with Congress on an economic relief bill, The Washington Post reported on Monday.

- But the White House would still rather get a bill through Congress, The Post reported, and President Donald Trump has said his priorities are boosted unemployment checks and an eviction moratorium.

- Negotiations between the White House and Democrats are at an impasse over unemployment insurance.

The Trump administration is weighing whether to take unilateral action if it doesn’t come to an agreement with Congress on another economic relief bill, The Washington Post reported on Monday, citing two sources who were granted anonymity to discuss the deliberations.

No final decisions were made, and the administration would still rather get legislation through Congress, the sources told The Post.

President Donald Trump said last week that his biggest priorities in negotiations over another stimulus bill were an extension of enhanced unemployment insurance and another moratorium on evictions.

Both measures were implemented under the economic relief package enacted in March. But they expired in late July, and Congress has not moved to extend them.

It’s not clear how the White House could circumvent Congress on the matter, but the administration has pushed the boundaries of executive power over the past three years.

The White House did not immediately respond to a request for comment.

Discussions on a spending package between White House officials and top congressional Democrats are at an impasse on unemployment insurance, The New York Times reported on Sunday.

Republicans unveiled their $1 trillion spending package four days before the $600 federal unemployment benefit ended on Friday. They proposed cutting the benefit to $200 a week for two months and designing a 70% wage-replacement program to start in October.

But Democrats want to extend the $600 supplementary payments — that was part of their $3 trillion spending package that the House passed in mid-May.

Nearly 30 million Americans are receiving unemployment benefits, per the Labor Department.

GOP lawmakers proposed a skinny bill that would deal only with unemployment benefits and the moratorium on evictions. Democrats rejected it and are pushing to pass their more expansive legislation to address a range of healthcare and economic priorities like emergency fiscal aid to states.

Senate Minority Leader Chuck Schumer, House Speaker Nancy Pelosi, Treasury Secretary Steven Mnuchin, and the White House chief of staff, Mark Meadows, met on Saturday to continue the talks. But a deal remains elusive, Pelosi told ABC News on Sunday.

“The fact is we will be close to an agreement when we have an agreement,” Pelosi said.

Congress holds the purse strings, I don’t know where he thinks he can get this kind of money. This announcement must be for PR purposes.

Ok this was in the WaPo article linked in the BI piece

Stephen Moore and Phil Kerpen, two outside economic advisers to the White House, published a Wall Street Journal opinion piece on Sunday urging Trump to declare a “national economic emergency” and announce that the Internal Revenue Service would temporarily defer the collection of payroll taxes. The effect would be to cut payroll taxes for workers, something Trump has long sought, although the legality of such a maneuver could come under immediate attack.

Here’s that WSJ op-ed

This is way more of a convoluted plan than just what either side of the Senate have proposed. Not sure how this would help people who are unemployed or underemployed right now, as they already don’t have money to pay taxes.

Mortgage rates pulled down to lowest levels in history

The 30-year fixed mortgage rate, the most popular home loan product, sank to its lowest level on record. It fell to 2.88 percent with an average 0.8 point, according to the latest datareleased Thursday by Freddie Mac. (Points are fees paid to a lender equal to 1 percent of the loan amount and are in addition to the interest rate.) It was 2.99 percent a week ago and 3.6 percent a year ago. Since November 2018, when it was 4.94 percent, it has fallen more than two percentage points.

The 30-year fixed rate has never been this low since Freddie Mac began tracking mortgage rates in 1971. It surpassed the previous low of 2.98 percent, set last month. This is the eighth time since March that the 30-year fixed rate has fallen to a new low.

This is good for those who can afford it but inventory is still low. It’s still a sellers market for the most part.

Cross-posting

Different Names, Same Address: How Big Businesses Got Government Loans Meant for Small Businesses

ProPublica found at least 15 large companies that received over half a billion dollars in PPP loans using the same technique: Getting multiple loans sent to smaller entities they own.

The Paycheck Protection Program was launched to rescue the little guy, the millions of small businesses without the deep pockets needed to survive the COVID-19 shock.

But among the restaurants, dentists and mom-and-pops was Vibra Healthcare, a chain of hospitals and therapy centers spread across 19 states with over 9,000 employees. The biggest PPP loan was supposed to be $10 million, but Vibra found a way to land as much as $97 million.

In other contexts, Vibra boasts annual revenues of $1 billion, but when the company got in line to receive what is essentially free government money (the loans are forgivable), it made itself seem small. From Vibra’s corporate address in Pennsylvania, 26 limited liability companies received PPP loans, 23 of them from the same bank, with almost all the loan approvals coming on the same day in April.

ProPublica found several other large businesses employing the same apparent strategy of counting each of their LLCs or other entities as a separate business. In Las Vegas, a casino operator backed by hedge funds got 20 loans. Two nursing home chains received tens of millions of dollars: One chain in Illinois got loans for 51 different entities, while another based in Georgia got 19. Together, ProPublica was able to identify up to $516 million that flowed to just 15 organizations.

ProPublica’s findings bring into sharper focus how companies with thousands of employees were able to get assistance, just as some small businesses were reluctant to even apply. So far, the PPP has paid out more than $517 billion to 4.9 million companies — loans that can be forgiven if used to cover payroll, rent, mortgage interest or utilities. It was among the most generous of programs for businesses in the CARES Act. Loan programs for medium and large businesses spelled out in the bill generally were not forgivable. Appraisals of the PPP by economists and policymakers have been mixed: While the program did inject hundreds of billions into the economy, it did not do so efficiently, often sending aid where it was less needed, and going through banks meant well-connected businesses had a far easier time getting their share.

Amanda Fischer, policy director of the Washington Center for Equitable Growth, said there should have been enough money available to help every company quickly — even those with large payrolls. “But if we’re not going to do that, I do understand concerns about businesses that don’t technically comply, and it’s not a good look.”

“It’s Congress’ fault,” she said. “We should have helped everyone, or targeted the neediest businesses instead.”

The Small Business Administration generally defines small businesses as those with 500 employees or fewer. Congress carved an exception into the CARES Act for restaurants and hotels, allowing them to count each location as its own business, but after large restaurant chains like Shake Shack disclosed they’d taken PPP loans, the Treasury Department responded to the uproar by changing the rules to set $20 million as the maximum any one corporate group could accept. Businesses that had taken more, the government said, had to give the money back.

The chains we identified were not restaurants or hotels, but experts told ProPublica that, without knowing all the details of an entity’s control, it is difficult to say definitively whether a company had broken the program’s rules.

Fifty-one separate limited liability companies or other business entities tie back to the headquarters of Peoria, Illinois-based Petersen Health Care, which runs nursing homes and other health facilities in the region. The loans would secure at least 6,200 jobs, records show, which would total more than $52 million if the chain got the maximum amount of funding. (When the SBA released information about PPP recipients last week, it only provided ranges for the amount of each loan.)

At least 30 of those entities are nursing homes or care facilities in Illinois, according to state business documents and data from the federal Centers for Medicare and Medicaid Services. More than a third were given Medicare’s lowest 1-star rating, which the government considers “much below average” when examining health inspections, staffing and other quality measures. The loans would support about 1,900 jobs among those facilities.

The firm and its owner, Mark Petersen, did not respond to phone messages and emails seeking comment. A person who answered Petersen’s main number last week transferred ProPublica to the company’s legal department, which did not return a voicemail seeking comment.

In Maryland, a different set of 19 loan recipients traced back to an office park about 30 minutes north of Baltimore. Business records show most of those companies had another Georgia address, the home of Mariner Health Care Inc.

Mariner, which was acquired in 2004 by National Senior Care Inc. for $615 million, has 20 nursing homes and care centers in Southern California and the San Francisco Bay Area, according to its website. Those companies could receive as much as $31 million in maximum SBA funding, data shows, which could help safeguard more than 1,600 jobs.

Mariner did not answer phone calls at its main number, nor did the company respond to emails sent to an address on its website.

Another big beneficiary of the small-business program was Las Vegas-based Maverick Gaming, which has been on a casino-buying spree, backed by hedge funds, since it launched in 2017. The company owns and operates 26 casinos across three states. The company was valued at about $1 billion, Maverick CEO and owner Eric Persson told the trade magazine Global Gaming Business last year.

SBA data shows upward of $46 million going to Maverick’s companies, all of the loans arranged by the same bank. Persson, reached by phone, declined to comment.

Vibra, from its base in Mechanicsburg, Pennsylvania, specializes in hospitals that provide “post-acute” care to recovering patients. Its CEO, Brad Hollinger, has drawn on Vibra’s success to become a player on the international racing circuit: He’s a major shareholder of the British Formula One team Williams Racing. Although a car racing enthusiast, he said in 2015 that he’d bought into the team primarily for business reasons. “I am never in business not to make money,” he told Reuters.

The PPP loans are just one way the company has been buoyed by the CARES Act: Vibra hospitals have also received at least $13 million in grants for health care providers and $41 million in loans (in the form of advanced Medicare payments), according to Good Jobs First, a government and corporate watchdog based in Washington.

In publicity materials, Vibra refers to its hospitals and rehab centers as “affiliates,” but for purposes of the PPP, it appears to have treated all these LLCs as unrelated companies, receiving between $42 million and $97 million in total. Together, the companies reported retaining a total of 4,600 jobs.

Twice in recent years, Vibra has been penalized for bilking the government. In 2016, Vibra paid $33 million to the Justice Department to settle allegations that it had defrauded Medicare by admitting and keeping patients for unnecessarily long stays in order to drive up billings. Last November, Vibra paid $6 million more in a different settlement with the government; this time, it had allegedly billed Medicare for doctor visits that did not happen. In the settlements, Vibra did not admit to any wrongdoing.

There are signs that Vibra is weathering the COVID-19 outbreak well. Last month, the company announced it would manage a new hospital being constructed in Bakersfield, California. The company did not respond to multiple requests for comment.

Generally, the SBA looks at “the entirety of the organization” in determining whether businesses should be considered affiliates or separate businesses, which means taking into account “common ownership, intertwined management and economic dependence between entities,” said Megan Jeschke, a partner at the law firm Holland & Knight. In her experience defending companies accused of violating the affiliation rules, the SBA has tended to be “rigid” in interpreting the rules and frequently finds that apparently related companies are in fact affiliates, she said.

After large businesses were revealed to have taken PPP money, Treasury Secretary Steven Mnuchin said in late April that the SBA would conduct a “full review” of each PPP loan of $2 million and up. As of last week, about 29,000 such loans had been made. Given that volume, it’s unclear just how thorough the reviews might be. The SBA did not respond to a request from ProPublica seeking comment.

Last week, following pressure from watchdog groups and Congress, the Trump administration disclosed only those entities that were approved by banks for loans over $150,000. A consortium of news organizations, including ProPublica, had sued the administration under the Freedom of Information Act to release the full list of recipients and loan details.

“The vast number of PPP grants went to truly small businesses — but a lot of the money went to big businesses,” said Aaron Klein, policy director of the Brookings Institution’s Center on Regulation and Markets. “The media attention is going to focus, and crystallize, how much big businesses got out of this program.”

Did Your Company Get Bailout Money? Are the Employees Benefiting From It?

ProPublica is reporting on the government’s various programs to support businesses amidst the epidemic. We want to know what these programs mean for your workplace. Please help us report.

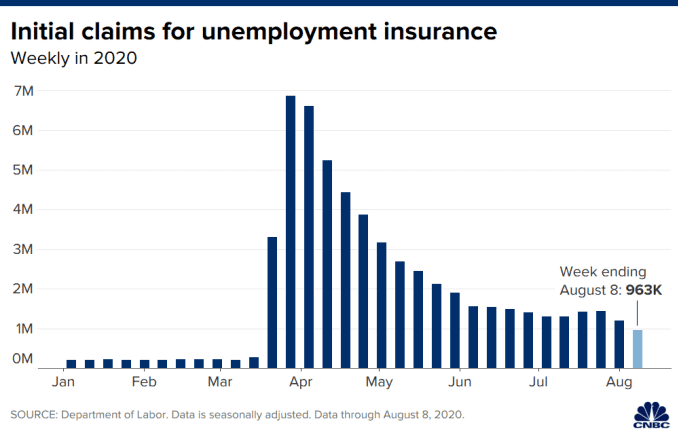

U.S. weekly jobless claims fall to 963,000, first time below 1 million since mid-March

First-time claims for unemployment insurance last week fell below 1 million for the first time since March 21 in a sign that the labor market is continuing its recovery from the coronavirus pandemic.

The total claims of 963,000 for the week ended Aug. 8 were well below the estimate of 1.1 million from economists surveyed by Dow Jones. That represented a decline of 228,000 from the previous week’s total.

Jobless claims had totaled above 1 million for 20 consecutive weeks as the U.S. economy went into lockdown to contain Covid-19. The last time the total was below that number was March 14, with 282,000, just as the pandemic declaration first hit.

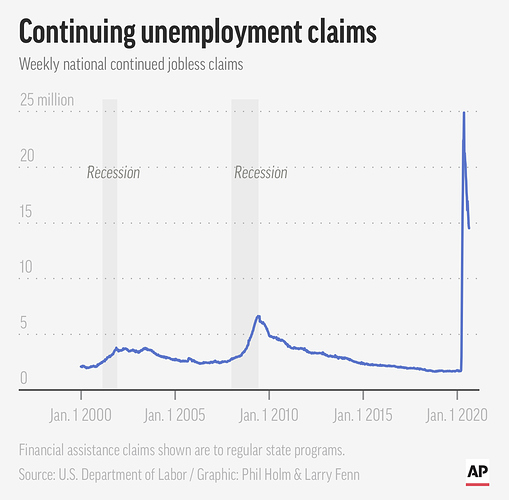

While the sub-1 million reading marks a milestone, there’s still plenty of work to do for the job market to get back to normal. Those collecting benefits for at least two weeks, known as continuing claims, totaled nearly 15.5 million, a decrease of 604,000 from a week ago, but still well above pre-pandemic levels.

Listen: What is the economy, stupid?

Vox’s Emily Stewart joins Dara and Jane to discuss the relationship between “the market” and the “real economy.”

Resources:

“The Stock Market Is an Engine of Civic Destruction” by Libby Watson, New Republic

“Who gets to be reckless on Wall Street?” by Emily Stewart, VoxHosts:

Dara Lind (@DLind), Immigration reporter, ProPublica

Jane Coaston (@cjane87), Senior politics correspondent, Vox

Emily Stewart (@EmilyStewartM), Reporter, Vox

Stocks are officially in a ‘bull market’ again. Here’s what that means.

The S&P 500 closed at a record on Tuesday, a remarkable display of investor optimism in the face of a still-shambolic American economy.

But aside from standing as testament to the sunny disposition of stock market investors, the record high also confirms the transfer of power from Wall Street’s pessimists — or “bears” — to the “bulls” who see more gains ahead.

Simply put, the record on Tuesday confirms that American investors are in a bull market again. We say ‘confirmed’ because the start of the bull market is actually traced back to when stocks hit rock bottom — which means it has been going on since March.

There’s no science behind the system for determining the start or end of a bull or bear market. It’s just tradition.

By that tradition, entry into a bear market is confirmed once stocks have fallen 20 percent from their high. That happened in mid-March, after the market crashed as the coronavirus crisis slammed the United States.

A bull market has its own criteria. Even though stocks were already up more than 50 percent from their lowest point (hit on March 23), some market traditionalists say that the bull market is only confirmed once stocks close at a record. That’s what just happened.

Why does any of this matter? Because markets often operate as something of an experiment in mass psychology. There’s a symbolic value to whether commentators, the news media and even the president are able to describe the context of the market as good or bad.

The last bull market grew out of the ashes of the 2008 financial crisis, with the S&P 500 beginning its run in March 2009, and rising more than 300 percent in almost 11 years.

That doesn’t mean the current bull market will last as long. The last one was about twice as long as usual. But this one is just getting started.

U.S. economy plunged an annualized 31.7% in second quarter

The U.S. economy shrank at an alarming annual rate of 31.7% during the April-June quarter as it struggled under the weight of the viral pandemic, the government estimated Thursday. It was the sharpest quarterly drop on record.

The Commerce Department downgraded its earlier estimate of the U.S. gross domestic product last quarter, finding that the devastation was slightly less than the 32.9% annualized contraction it had estimated at the end of July. The previous worst quarterly drop since record-keeping began in 1947 was a 10% annualized loss in 1958.

Last quarter, businesses shuttered and millions of workers lost jobs as the world’s largest economy went into lockdown mode in what succeeded only fitfully in limiting the spread of reported viral infections. The U.S. economy fell an annualized 5% in the first three months of the year as the coronavirus began to make its presence felt in February and March.

A bounce-back in hiring as many businesses reopened suggested that the economy began to recover in June with third quarter growth estimated to be around 20% annualized. But economists say a full recovery remains far off given that the virus has yet to be contained and the government’s financial support has faded.

“As we approach the fall, we see four important risks for the economy: a failure to provide further fiscal stimulus, a second wave of COVID-19 infection during the flu season, major election uncertainty and rising trade tensions with China,” said Lydia Boussour, senior U.S. economist at Oxford Economics.

Unemployment is still high at 10.2%, and roughly 1 million people are applying for jobless aid each week even as the amount of aid they receive has shrunk. Consumer confidence has tumbled. Though the stock market and home sales are surging, the broader economy shows signs of stalling, and millions face potential evictions from their homes.

The challenges reflect the unusual nature of the downturn. Many U.S. households have increased their savings and paid off debt—which could either signal a hesitancy to spend as they have in the past or pent-up demand that could be unleashed once the pandemic ends.

More than 1 million Americans file for unemployment, again

Just over 1 million Americans applied for unemployment benefits last week, a sign that the coronavirus outbreak continues to threaten jobs even as the housing market, auto sales and other segments of the economy rebound from a springtime collapse.

The Labor Department reported Thursday that the number of people seeking jobless aid last week dropped by 98,000 from 1.1 million the week before.

The number of initial claims has exceeded 1 million every week but one since late March, an unprecedented streak. Before the coronavirus pandemic, they had never topped 700,000 in a week.

“Layoffs are ongoing reflecting interruptions to activity from virus containment that are likely resulting in permanent closures and job losses,” Rubeela Farooqi, chief U.S. economist at High Frequency Economics, wrote in a research report.

Farooqi added that “the risk of permanent damage to the labor market remains high which will slow the pace of recovery. The return to pre-pandemic levels of prosperity is set to be an uncertain and prolonged process.”

More than 14.5 million are collecting traditional jobless benefits – up from 1.7 million a year ago – a sign that many American families are depending on unemployment checks to keep them afloat.

U.S. Debt Is Set to Exceed Size of the Economy Next Year, a First Since World War II

U.S. debt has reached its highest level compared to the size of the economy since World War II and is projected to exceed it next year, the result of a giant fiscal response to the coronavirus pandemic.

The Congressional Budget Office said Wednesday that federal debt held by the public is projected to reach or exceed 100% of U.S. gross domestic product, the broadest measure of U.S. economic output, in the fiscal year that begins on Oct. 1. That would put the U.S. in the company of a handful of nations with debt loads that exceed their economies, including Japan, Italy and Greece.

This year the ratio is expected to be 98%, also the highest since World War II.

Dang, that’s bad. I mean if you’re the kind of person who stresses out about the US debt to GDP ratio. This was a thing people used to argue about right?