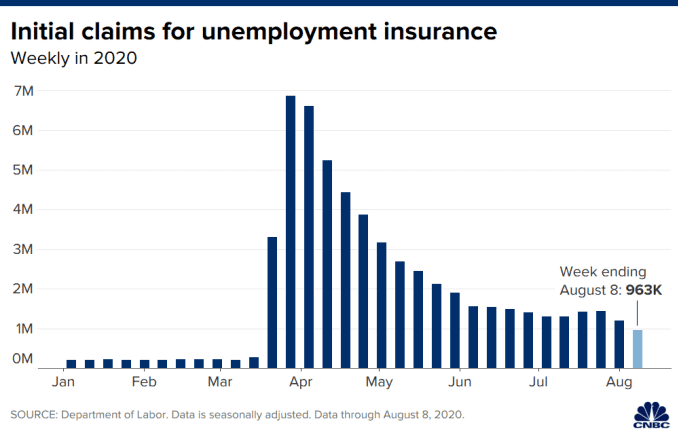

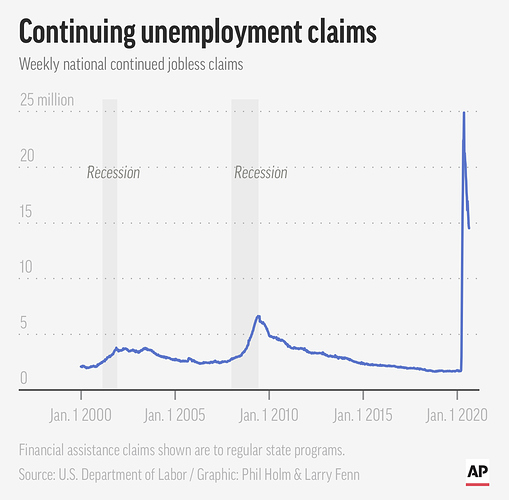

The economic recovery depends on a healthy nation, and getting the Coronavirus under control, which at this juncture seems like a far off notion unfortunately given the lack of leadership, and lack of adherence to wearing masks, keeping distanced etc. The one specific deadline which Congress should be especially wary of would be the umemployment relief - with R’s offering to do a week’s patch for unemployment benefits and Dems saying no, we won’t work piecemeal.

The bigger picture, beyond the nation stricken with the rising numbers of Covid-10 is of course is huge unemployment now with the Senate now negotiating at the 11th hour over umemployment benefits, the $600 addition to them, liability issues for companies and institutions, how much to spend towards testing, tracing etc and a way back.

Congress is now in recess officially with a few leaders negotiating now for a final bill.

Read where they are…some happy talk, with some read blockades towards resolving it.

Washington (CNN)The US economy, plagued by a resurgent pandemic, is showing signs of sliding backwards.

Key deadlines on extending a federal eviction moratorium and federal unemployment benefits have come and gone. Yet lawmakers and the White House, sources say, are as far apart as they’ve ever been in talks on the next emergency aid package.

As one person involved told CNN on Sunday night: “No clue how we get this done at this point. Just so much outstanding.”

Bottom line

Negotiators on both sides emerged from a three-hour-plus meeting on Saturday with by far the most positive words about where things stood. What that really underscored was just how much of a mess these talks have been. The meeting was productive because negotiators left with a better understanding of the full scope of disagreements (and areas of potential agreement), according to two sources. Not because they’d made headway toward an actual deal.

What to read

Very good recap of a day that underscored Saturday’s optimism was short-sighted.

What to watch

Treasury Secretary Steven Mnuchin and White House chief of staff Mark Meadows will be back on Capitol Hill to meet with Speaker Nancy Pelosi and Senate Democratic Leader Chuck Schumer.

The framing

Pelosi and Mnuchin dig in on stimulus positions ahead of scheduled Monday talks

To understand why the two sides remain so far apart, it’s worth comparing how each is framing the scale of the crisis. Mnuchin, during the talks over the initial $2.2 trillion CARES Act, dismissed concerns about deficits due to historically low borrowing costs and the urgency of the moment. That has shifted – on Sunday he made a point of noting concerns about adding to much to the national debt in the next round.

This, on the other hand, was how Pelosi framed things in a letter to her House Democratic colleagues on Saturday night:

“All parties must understand the gravity of the situation in order to reach an agreement that protects Americans’ lives, livelihoods and the life of our democracy.”

There are a large number of policy differences here, but the biggest issue throughout the first week-plus of real negotiations has been the lens through which the two sides view the scale of the current crisis. And until that starts to merge, at least somewhat, there is no deal to be had.

The timing

The policy deadlines, at least up to this point, didn’t spark a deal. The Senate is scheduled to leave for August recess at the end of this week, but there’s zero sense something will come together before then. Neither side wants to leave town for the month without reaching an agreement, but at this point, that agreement – and then the process of actually getting it through both chambers – is a long way off.

"I’m not optimistic that there will be a solution in the very near term," Meadows said on CBS’s “Face the Nation.”

…

Addressing the “unilateral” idea

There has been chatter for several weeks that the White House may look to pursue unilateral options to address the economy if it feels a deal with Democrats is out of reach. On Capitol Hill, those who were aware of the talk mostly just laughed it off. But it spilled into public view Monday with The Washington Post reporting it was becoming a very real option given how far apart the two sides remain.

Let’s go ahead and address this head on: there is nothing the White House can do on unemployment benefits unilaterally. There is nothing they can do in terms of sending out another round of stimulus checks. There is nothing they can do on liability protections. There are limits to what they can do regarding an eviction moratorium. There is nothing they can do in terms of allowing hard-hit small businesses to access a second Paycheck Protection Program loan.

…

The biggest holdups

(Again, these are the biggest picture items. There are dozens of smaller-bore issues that will also create disagreement or problems that the negotiators haven’t really gotten to yet, sources say.)Federal unemployment benefits State and local funding Liability protections Postal Service fundsThe areas of agreement

Paycheck Protection Program Direct Payments