Cross posting, forgot Econ news usual comes out Thursdays, it is Thursday isn’t it?

Meatpacking Plants Deny Workers Comp to Thousands Who Contracted COVID-19

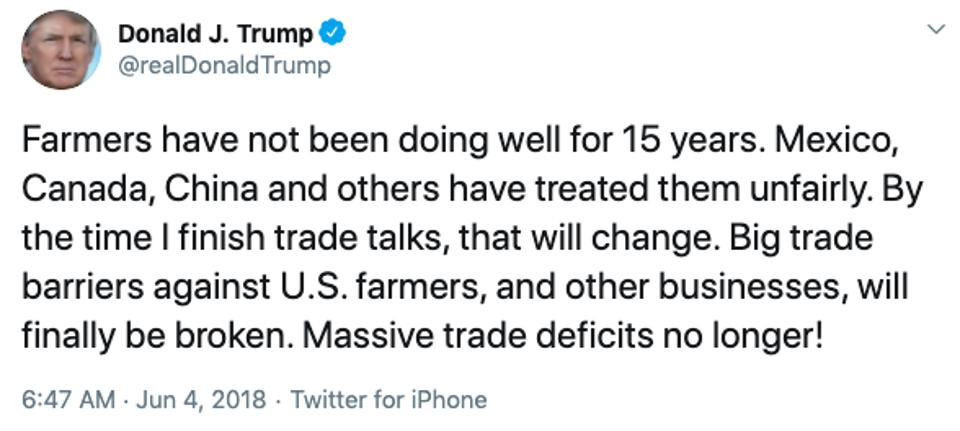

Trump Isn’t Delivering On Reducing The Trade Deficit

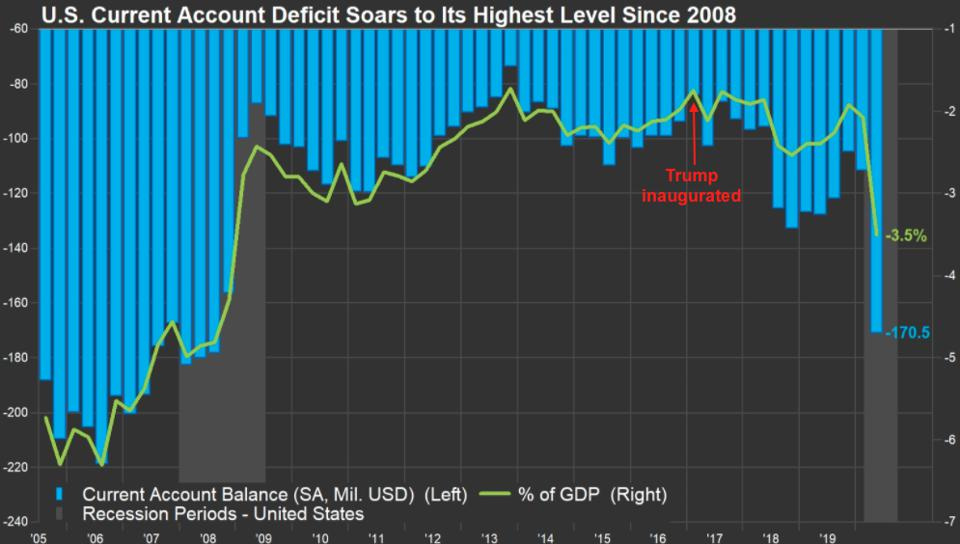

President Trump campaigned on reducing if not eliminating the U.S. trade deficit. He has failed to deliver on this as the trade deficits in 2018, 2019 and based on the current pace for 2020 they will be the largest since 2008, before President Obama took office.

While Trump talks about trade deficits, what he has really focused on is the Goods deficits as Services from the U.S. runs a surplus. The graph below shows how the gap in Goods exports and imports has remained fairly stable and has actually grown over the past two years. In August 2018 the Goods deficit was approximately $70 billion and it has grown to $82.9 billion in August this year.

Sara Potter from FactSet Research Systems wrote, “Looking ahead, the monthly data we have so far for international flows in the September quarter isn’t encouraging. The U.S. Census Bureau reported earlier this month that the July trade balance of goods and services fell to negative $63.6 billion, the biggest deficit since July 2008. The services balance, where the U.S. maintains a surplus, fell to its lowest level in eight years; at the same time, the goods deficit fell to an all-time low of $80.9 billion (balance of payments basis). While both exports and imports have recovered somewhat in recent months from their recent lows, exports of goods and services remained down 20.1% in July compared to a year ago while imports were off by 11.4%.”

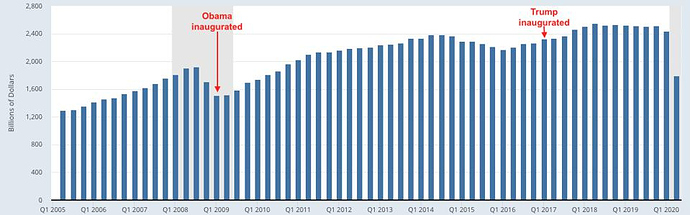

While trade does negatively impact sectors of the economy and the jobs associated with them, overall it tends to be a net benefit to the economy. Consumers receive lower prices and/or a wider range of goods and companies gain access to additional markets. Unfortunately, Trump’s lack of understanding of trade’s benefits has overwhelmed his desire to see it reduced, if not eliminated.

One aspect to the chart below shows how increasing exports help the economy grow. However, when Trump started various trade wars they flattened out. Exports then took a nosedive when countries around the world shut down due to the coronavirus.

China Phase One trade deal

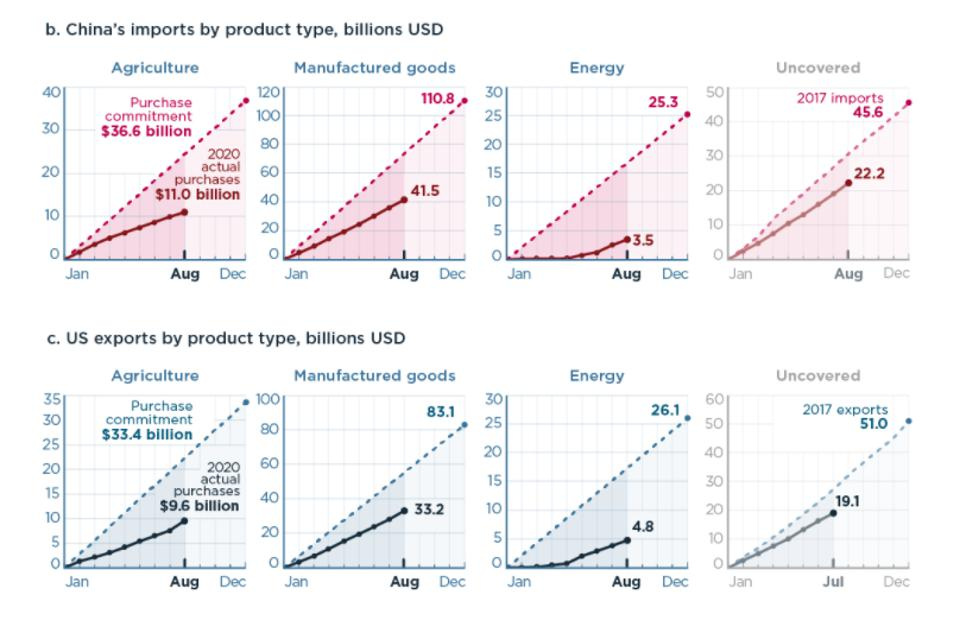

Trump’s Phase One trade deal with China is woefully behind on where it should be. While the coronavirus does have a lot to do with this, even before it hit exports to China lagged and had goals that were going to be very hard to achieve.

Chad Bown from the Peterson Institute for International Economics has been tracking the amount of U.S. exports to China and how they stack up to the Phase One trade deal. He wrote, “Through August 2020, China’s year-to-date total imports of covered products from the United States were $56.1 billion, compared with a prorated year-to-date target of $115.1 billion. Over the same period, US exports to China of covered products were $47.6 billion, compared with a year-to-date target of $95.1 billion. Through the first eight months of 2020, China’s purchases of all covered products were thus only at 50 percent (US exports) or 49 percent (Chinese imports) of their year-to-date targets.”

Note that the difference between the Chinese imports and U.S. exports numbers is due to, “As set out in the legal agreement, one 2017 baseline scenario allows for use of US export statistics and the other allows for Chinese import statistics” per Bown, which also comes into play for the full year amounts.

Bown also points out that, “prorating the 2020 year-end targets to a monthly basis is for illustrative purposes only. Nothing in the text of the agreement indicates China must meet anything other than the year-end targets.”

So far China has imported about half of their full year commitments but the year is two-thirds over.

Big Tech meltdown and rising virus cases lead S&P 500 to worst week since March.

- Stocks fell on Friday, dropping for the fourth time in the past five days in a retreat that has added up to Wall Street’s worst week since March, as rising pandemic cases, new shutdowns and a sell-off in large technology stocks all dragged the major benchmarks lower.

- The S&P 500 fell 1.2 percent, bringing its loss for the week to 5.6 percent. That’s its biggest weekly drop since the week through March 20, when stocks plunged 15 percent before they began to rebound after the Federal Reserve and lawmakers in Washington stepped in to bolster the economy. The Dow Jones industrial average fell 6.5 percent this week.

- The latest sell-off has come as a second wave of cases forced more lockdowns in Europe, threatening the economic recovery and spooking investors around the world. In the United States, a record number of cases is prompting city and county governments to start imposing some curfews and limits on gatherings.

- And trading has been volatile for much of October, with investors whipsawed by expectations about whether Congress and the White House would agree on a new economic relief plan, anticipation of a contested election next week and concern about the sharp rise in virus cases.

- The decline on Friday leaves the S&P 500 with a gain of 1.2 percent for the year. As recently as Oct. 12, the index was up more than 9 percent for the year.

- “The Covid infections are moving in the wrong direction at a pretty quick pace, not just here in the U.S., but globally as well, so there’s a lot of concern about that among investors,” said Chris Larkin, managing director of trading and investment products at E-Trade Financial.

- Concern about the economic impact of any pandemic-related shutdown has been particularly evident in energy markets. West Texas Intermediate crude, the American benchmark, fell 1 percent on Friday, bringing its losses to 10 percent for the week, its biggest five-day decline since April.

- In the stock market on Friday, big technology stocks led the retreat even after many of them reported a jump in profit. Twitter was the worst-performing stock in the S&P 500, dropping 21 percent, after its user growth fell short of expectations. Apple fell more than 5 percent, after it said a delay in the release of the iPhone 12 led to a drop in iPhone sales.

- Facebook and Amazon were also sharply lower. Alphabet was the only one of the four tech giants that reported results on Thursday to gain, climbing more than 3 percent after reporting a rise in advertising on Google and YouTube. The Nasdaq composite fell 2.5 percent.

- Shares in Europe were mixed on Friday, with the Dax in Germany and the FTSE 100 in Britain lower, while the CAC 40 index in France rose slightly.

- Data published Friday showed Europe’s economy recorded its strongest rebound on record in the third quarter, jumping 12.7 percent from the previous quarter in countries that share the euro. But the latest lockdowns mean economists are now worried about a double-dip recession, if economic growth is wiped out by weeks of orders to stay at home and the closure of bars, restaurants and nonessential shops.

This topic was automatically closed 15 days after the last reply. New replies are no longer allowed.